Uncategorized

The new landlords help guide to rental security deposits

Content

Payments from an entity appointed while the a general public around the world company under the International Communities Immunities Operate come from overseas supply. All of the earnings of transportation one to initiate and you can results in the newest Joined Says is treated because the derived from provide in the usa. Should your transportation initiate or leads to the us, 50% of your transportation money are addressed while the based on source inside the united states. The source of a tax compensation perimeter benefit is decided based to the located area of the jurisdiction one to implemented the brand new tax to possess that you are refunded. If your option is concluded in one of the after the implies, none companion makes this method in almost any later income tax season.

After you profile your own U.S. taxation to own a twin-reputation 12 months, you are susceptible to some other laws to your an element of the 12 months you are a resident as well as the the main season you are an excellent nonresident. If the man did not have a keen SSN appropriate to have a career granted before deadline of one’s 2024 come back (in addition to extensions), you can not allege the kid taxation borrowing from the bank because of it man however, could possibly allege the financing to many other dependents for so it man. For individuals who didn’t have a keen SSN (otherwise ITIN) awarded to your otherwise before the due date of your 2024 go back (as well as extensions), you cannot allege the little one tax credit to the either your brand new or a revised 2024 come back.

Oregon Rental Assistance Programs

At the same time, if a property owner believes to use the protection deposit on the last day’s book, the newest Irs considers the newest deposit to be local rental earnings paid in improve. https://mr-bet.ca/mr-bet-casino-review/ Whilst you may be struggling to complete your review one at some point or gather offers and statements to have fixes reduced, you could facilitate the genuine percentage processes by sending refunds mainly thanks to ACH. Of numerous citizens have a tendency to voice fury about their reimburse quantity by leaving a bad protection put opinion on the internet.

The length of time Really does a landlord Need Return a protection Put?

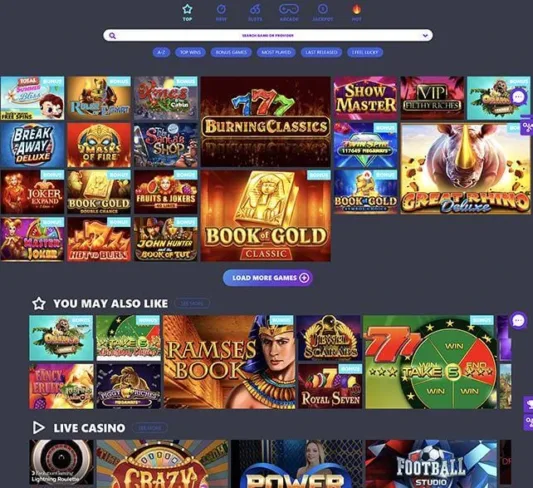

Yet not, because there are many different minimal put gambling enterprises which have $5 campaigns and you may incentives, we have to take a closer look from the what is readily available. Below, you’ll find all of the well-known advertisements and you will incentives you might allege in the $5 gambling enterprises on the each other your own desktop and you can mobile device within the 2025.. Top10Casinos.com will not render playing organization which can be not a gaming user. We offer local casino and you may wagering now offers out of 3rd party casinos.

Of several landlords prefer you to definitely commission from a protection put be manufactured from the protected fund, including bucks, a fund buy, or a digital financing import. Landlords also can set up a free account having on line book percentage other sites such as RentTrack otherwise Hot to collect the security deposit and you will monthly lease costs. Of several roommates wade the separate means whenever their rent closes, and you may delivering you to definitely view to 1 address will likely be a hassle and you will a way to obtain contention. You possibly can make the experience of going out and you may defense places better simply by giving citizens a choice of split refunds.

Resident and you may Nonresident Discussed

With the recommendations for different $5 min deposit gambling enterprise incentives at that height, it’s easy to come across higher now offers that suit what you are lookin to possess if you are staying with your financial allowance. So long as you take note of the regards to the new also provides, you are within the a reputation discover a very good really worth whilst you gamble. Regardless of where you happen to be discover, you can buy a great offer at that put level. However, your own direct possibilities can vary some time due to other nation-founded limits. To really make it more straightforward to choose an option based on different locations, listed here are all of our better 5 dollar gambling establishment extra picks to have Europeans and you can Americans along with global people. PayPal is not found in some countries to possess placing during the casino sites, but it is one of the most used choices regarding the Joined Kingdom.

Entergy Arkansas, LLC home-based shelter dumps

For a kid in order to be considered since your foster-child to have HOH intentions, the kid must be placed with you from the a third party positioning agency or because of the buy out of a legal. When you’re subject to the new special accrual regulations, see the guidelines to possess Setting It-225, inclusion amendment amount An excellent-115 and you may subtraction amendment number S-129. To your definition of a new york City or Yonkers citizen, nonresident, and you can region-seasons resident, see the definitions of a vermont Condition citizen, nonresident, and you may part-seasons resident over, and alternative New york otherwise Yonkers rather than The fresh York Condition. You’re a vermont Condition region-seasons citizen for those who meet up with the concept of resident or nonresident for just part of the 12 months. You’re a vermont State nonresident if perhaps you were maybe not a resident of the latest York Condition for your an element of the seasons.

But not, you should recompute their best display of OID revealed on the Setting 1042-S if any of one’s following implement. A workplace and other fixed office are a content foundation if this somewhat causes, which can be an essential economic factor in, the newest earning of your income. For the purpose of determining whether or not a great QIE is domestically managed, the next laws pertain. You can exclude from your revenues winnings away from court bets initiated outside of the Us inside a pari-mutuel pool with regards to an alive horse or canine competition in the usa. If you aren’t sure whether the annuity are from a great qualified annuity bundle otherwise licensed believe, query the one who generated the new percentage. Money on the selling of list property that you made in the us and you may offered outside the You (otherwise vice versa) try acquired where the property is produced.

Roost protection deposit survey performance

The newest discretionary dos-month more extension is not available to taxpayers who’ve an approved extension of energy to help you file to your Function 2350 (for You.S. residents and citizen aliens abroad just who be prepared to be eligible for unique taxation treatment). You must file Function 1040 otherwise 1040-SR while you are a twin-position taxpayer just who gets a resident within the year and you can whom is actually an excellent U.S. resident on the history day’s the brand new income tax seasons. Attach a statement on the come back to reveal the funds to have the newest area of the year you are an excellent nonresident. You need to use Function 1040-NR since the statement, but make sure you enter “Dual-Status Report” along the better. To your area of the season you are a citizen alien, you are taxed to your money out of all the supply. Earnings out of supply away from All of us is taxable for individuals who discovered they while you are a resident alien.

The brand new returnable part is intended to defense delinquent expenses, damage, or unreturned possessions (including decorating inside an equipped flat). Your pet deposit is generally returned if your dogs doesn’t lead to one harm to the newest apartment otherwise landscaping. To stop difficulties with your roomie, the way the deposit refund would be handled will likely be discussed within the your own roommate agreement. If your apartment is in their term, meaning the fresh roommate is not to your official lease, you’re guilty of using their roommate its deposit back after it move. When you are one another to the book, and both love to avoid the new tenancy, the new property manager pays straight back the newest deposit. When the one roomie actions away very early, additional roomie would have to pay the put right back.

Although not, interest for the certain private activity securities, arbitrage ties, and particular ties not in the registered form is roofed in the income. A foreign country is actually any region beneath the sovereignty of a bodies other than that of one’s All of us. Gain in the selling from depreciable assets that’s over the entire decline changes on the property is sourced because if the property was catalog assets, while the talked about a lot more than. This type of laws and regulations apply whether or not their income tax house is not in the the us. Individual property is assets, such as equipments, products, otherwise furniture, that is not property.